如果您想用比較穩定供貨的IC 或MCU 的話,您可以參考看看吧!

---

November 07, 2012 | |

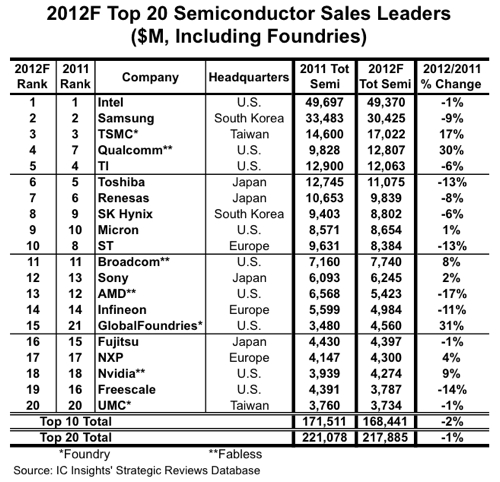

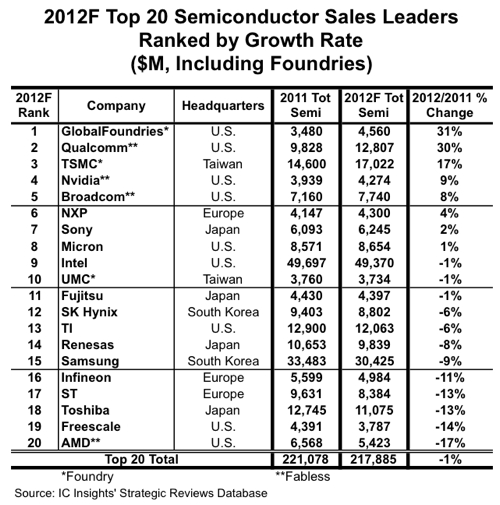

Top 20 Semiconductor Suppliers’ Sales Growth Rates Forecast to Range from Great (+31%) to Terrible (-17%) in 2012. GlobalFoundries, Qualcomm, and TSMC expected to register strong double-digit growth this year. A forecasted ranking and discussion of the 2012 top semiconductor suppliers will be included as part of IC Insights' upcoming November Update to The McClean Report. Also included in the November Update will be a listing of the top semiconductor industry capital spenders and a description of a “new” IC industry cycle model. Three pure-play foundries are expected to be in the top 20 ranking of leading semiconductor suppliers in 2012 (Figure 1). Combined, these three foundries are forecast to log a 16% increase in 2012/2011 sales, quite impressive considering the expected 2% decline in the worldwide semiconductor market this year. With the continued success of the fabless companies as well as the strong movement by many IDMs (Integrated Device Manufacturers like TI, Renesas, ST, etc.) to the fab-lite business model, IC Insights expects the IC foundries to witness very strong demand for their services over the next few years. In total, the top 20 semiconductor suppliers are forecast to register a 1% decline in sales this year (about $3.2 billion), one point better than the rate of decline expected for the total worldwide semiconductor market in 2012. The only expected movement with regard to the top 5 spots in the 2012 ranking is that fabless supplier Qualcomm is forecast to register a 30% surge in sales this year and move up three positions to replace TI as the fourth largest semiconductor supplier. In contrast, Freescale is forecast to register a 14% decline in semiconductor revenue this year and drop down three positions from 16th in 2011 to 19th in the 2012 ranking. Sales from pure-play foundry GlobalFoundries are forecast to jump by a strong 31% while foundry giant TSMC is expected to show a healthy 17% increase this year. Considering that AMD, the original “parent” and largest customer of GlobalFoundries, is forecast to show a steep 17% sales decline this year, it is obvious that GlobalFoundries’ current spike in revenue is being driven mostly by its success in attracting new IC foundry customers (e.g., ST, Freescale, Qualcomm, etc.). As a result of its excellent performance this year, GlobalFoundries is forecast to replace Elpida and move into the top 20 ranking for the first time, rising from the 21st spot in 2011 to 15th place in 2012. As shown in Figure 2, IC Insights expects there to be a wide range of growth rates among the worldwide top 20 semiconductor suppliers this year. It is interesting to note that despite the close on-going relationship between the two companies, GlobalFoundries (31% increase) and AMD (17% decline) are forecast to be the “bookends” on a 48-point growth range for the top 20 semiconductor suppliers in 2012. The continued success of the fabless/foundry business model is evident when examining the top 20 semiconductor suppliers ranked by growth rate. As shown, the top five performers are expected to include three fabless companies (Qualcomm, Nvidia, and Broadcom) and two pure-play foundries (GlobalFoundries and TSMC).

Figure 1 Illustrating the very difficult year faced by the majority of the top 20 semiconductor suppliers, 12 of the top 20 ranked companies are forecast to register a sales decline this year, including 7 of the top 10 largest semiconductor suppliers in the world (#1 Intel, #2 Samsung, #4 TI, #6 Toshiba, #7 Renesas, #8 SK Hynix, and #10 ST). Of the eight top 20 semiconductor companies forecast to register a sales increase this year, five are headquartered in the U.S. and include GlobalFoundries, Qualcomm, Nvidia, Broadcom, and Micron.

Figure 2 Report Details: The 2013 McClean Report Subscription and Strategic Reviews IC Insights is currently very busy working on its 2013 edition of The McClean Report. The 2013 McClean Reportsubscription includes the 400-page main Report released in January, the 200-page Mid-Year Update, the March through November Monthly Updates, as well as access to the three McClean Report subscriber-only Webcasts. The new 2013 McClean Report subscription is priced at $3,390 for a single user and $6,390 for a multi-user corporate license. IC Insights' Strategic Reviews database includes extensive profiles of more than 200 IC companies, including those companies with a fabrication facility as well as fabless IC suppliers. The profiles include financial highlights, company strategy, key personnel, products and services offered, process technologies employed, important strategic alliances, detailed fab data when applicable, and contact information. Over 2,000 hours a year are expended to keep this database current! An individual-user password to Strategic Reviews is available for $2,995 and is good for access to the database for one full year after the start of the subscription. A multi-user corporate-wide password is available for $4,995. |

沒有留言:

張貼留言